This might affect which products we review and blog about, yet it in no chance affects our suggestions or guidance, which are based in thousands of hours of research study. Our companions can not pay us to assure desirable testimonials of their products or services. And also if one lending institution transforms you down, do not assume they all will certainly-- because that's not just how home loan financing functions. For tips on how to raise your credit history quick, review our Guide to boosting your credit history.

I assume that I would call it commonsense financing, that remarkable word that has actually almost vanished from our language. It might differ depending upon your debt ranking-- as there can be a fine line in between 'reasonable' and also 'poor' credit report. With a lending backed by the federal government like an FHA loan, you can receive a home mortgage despite having a 500 credit score. It could be tempting to acquire a house asap, however it's far better to make the effort to assess available alternatives and also interest rates while you begin shopping for a loan. Allow's check out several of the funding alternatives readily available and the typical credit history needs for every of them.

- FHA fundings need a credit score of just 500 with a 10% down payment, as well as various other finances have no credit score demand in all.

- Attempt to remove your charge card balances every month and also avoid the restrictions.

- We recommend your regular monthly repayment does not exceed 28% of your gross earnings-- that's your income gross.

- It would certainly be a good suggestion to inspect your credit rating and also examine your credit score report with various free credit score suppliers, as they will make use of just one credit bureau.

- If you're looking to apply for a home mortgage and you have bad credit rating, you can take a variety of steps to enhance your chances of approval.

You can find out what they told us in our full story on home mortgage choices for customers with an inadequate credit history. It isn't impossible to get a home loan if you have an inadequate credit rating. Some lending institutions use certain items for people who have been turned down for traditional home loans. But prior to you select among these products there are steps you can require to improve your possibilities of being authorized for a cheaper traditional mortgage. There are mortgages created for people with a poor credit report rating as well as there are additionally easy steps you can take to improve your chances of being Helpful resources authorized for a home mortgage.

Just How Much Will A Poor Credit Report Home Loan Cost?

Yes, if you can satisfy the other qualification standards of your selected loan provider, you ought to have the ability to obtain a home loan in spite of a document of negative credit score. Bear in mind that some lending institutions top the amount they will loan to an applicant with serious poor credit, with a few only offering a maximum of an 85% loan-to-value for a home as well as 70% for a level. We see the larger photo - along with assisting you locate the appropriate home mortgage sale my timeshare now reviews bargain, our expert home mortgage advisors can save you time and money by offering relevant economic guidance. Youths, as an example, or those who've recently moved to the UK may discover they have no rating merely since they have not had time to accumulate a great one.

Exactly How Soon Can I Obtain A Home Loan Complying With Discharge From Insolvency

Every person has a various monetary and also personal situation and nobody home loan item is suitable for every single unique debtor. You could assume it's far better to apply alone but this might not constantly be the case as if you're both gaining http://riverugrc095.theburnward.com/what-does-it-indicate-when-your-mortgage-is-sold a revenue, your price for the mortgage quantity you require could be much better. That being stated, if you have negative credit history, you may still have a lot of choices to contrast and consequently, you could be able to obtain onto the building ladder faster than you assume. Lots of people involve us thinking they will not be eligible for a home mortgage since they have missed out on a repayment for a phone bill or since they have actually had a CCJ in the past.

Searching For A Bad Credit Score Home Mortgage

Store with lending institutions who concentrate on home mortgages for credit-challenged debtors. Assume you obtain a $350, year mortgage with a set 4.5 percent rate. Your monthly repayment would certainly be $1,773, and you would pay $288,583 in rate of interest over the 30-year funding term.

Bankrate.com is an independent, advertising-supported publisher and contrast service. We are made up for positioning of funded items as well as, services, or by you clicking on certain links posted on our site. Therefore, this payment may influence exactly how, where and in what order items show up within providing categories. Other factors, such as our own exclusive internet site guidelines as well as whether a product is provided in your location or at your self-selected credit report array can likewise influence just how as well as where products show up on this site.

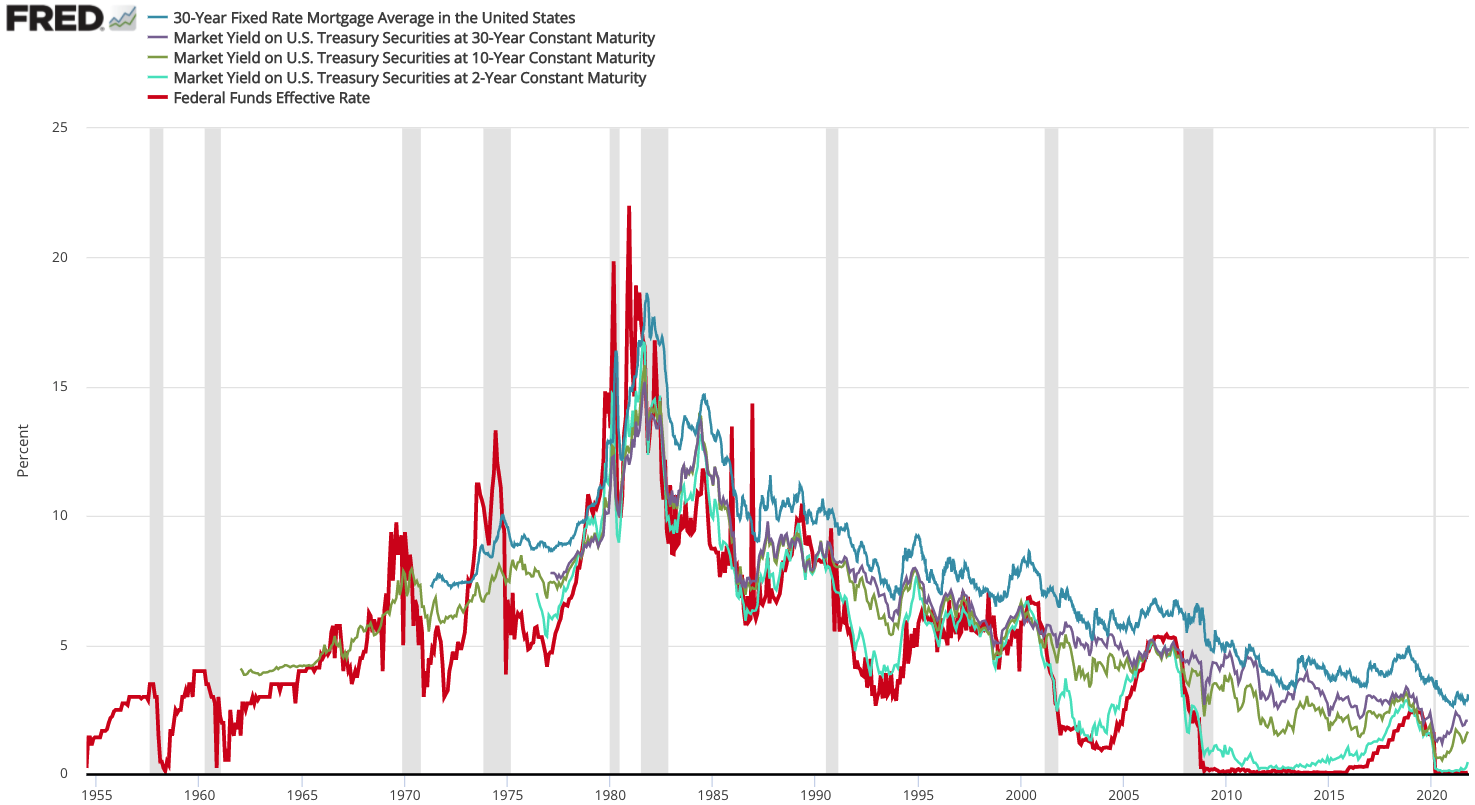

However, this will certainly depend upon the extent of the circumstances - prices can be up to below 3% if the negative credit history has been resolved as well as happened greater than three years ago. If you were paying 3.95% on a ₤ 150,000 negative credit score home loan over 25 years, you 'd pay ₤ 788 a month and also ₤ 236,286 in total amount. A home loan price, or else known as interest, is what a lender charges a borrower to get a mortgage. A set rate suggests the mortgage rate will stay continuous with the entire finance term. A variable rate will fluctuate throughout the term based upon a benchmark price.